-

Top 5 Algorand Wallets: Where to Hold Algorand

Algorand is a renowned green blockchain created to provide various technologies important to support decentralized finance (DEX). This merges sensible policies and an energy-friendly consensus to keep the earth green. It uses a native asset known as ALGO to support its agenda.

In this informative guide, we have discussed the leading five Algorand wallets.

- Atomic Wallet (widely available)

- Ledger Nano X (safest hardware wallet)

- Trust Wallets ( a trusted mobile wallet)

- Pera Wallet ( a compatible Algorand wallet)

- MyAlGO Wallet (top web-based browser)

What is Alogrand (ALGO)?

Algorand is both a blockchain and virtual currency platform. The platform is best for processing multiple transactions instantly, similar to many payment processors such as Visa or Mastercard. Also, ALGO can host other blockchain-based projects and digital currencies, making it a competitor to ETH (Ethereum). ALGO is the native coin of the platform and helps to save the Algorand blockchain and pay the processing cost for Algorand-based transactions.

Algorand is a green and open-source blockchain, meaning users can check and contribute to the platform’s code. Algorand utilizes the operating protocol it calls PoS (proof-of-stake), which employs network validators through the pool of users.

In 2017, Silvio Micali (a professor at the Massachusetts Institute of Technology and cryptographer) founded the platform and accompanying digital currency.

Top 5 Algorand Wallets

Before knowing about wallet selection, it’s essential to understand the prime criteria for choosing the best wallet.

Your wallet must be safe. The developers should offer good support and should be functional. Also, it must have a good reputation in the neighborhood. Developers of Algorand have launched it as its native blockchain, so there are not many wallets for other assets that are either dependent on various chains or have divided them. Also, there is a respectable selection accessible.

Atomic Wallet

Atomic Wallet is a reliable digital wallet for ALGO. Together with hundreds of other assets, it supports ALGO.

The wallet is a widely used crypto wallet for ALGO on desktop and smartphone devices. It supports Linux, Mac, Android, and iOS operating systems. The wallets provide a 12-word seed phrase so that you can keep your crypto assets safe. Users can use AES and TLS encryption protocols. It’s also non-custodial. So, users have complete charge of their private keys.

Atomic Wallet allows users to buy ALGO using their cards. The wallets cost nothing besides the network fees.’

Ledger Nano X

The best hardware crypto wallet currently is one from Ledger. A secure way to keep digital currency is hardware wallets. Users can store their private keys on impenetrable offline devices.

Many LEDGER hardware wallets are accessible, but only Nano S and X support ALGO. Ledger Nano X and Algorand Mobile Wallet are compatible. Users can stake ALGO and other DeFi (decentralized finance) tokens with Ledger, making this hardware wallet a good option.

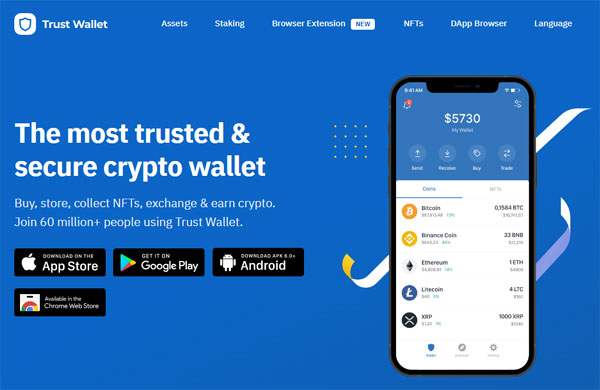

Trust Wallet

Trust Wallet is another wallet that is compatible with ALGO. It is a product from the Binance network and a reputable virtual currency wallet. A mobile wallet is known as a Trust wallet that is available in Google and Apple Play stores.

It offers the top level of safety to your ALGO using different layers of safety. To find vulnerabilities and issues, the company audits the network frequently. The data is private as it doesn’t need KYC.

You can download it from the stores for free, and the wallet has an easy-to-use and intuitive user interface. Also, users can stake ALGO and earn passive income via Trust Wallet. You stay in the application as an outcome of an in-built chart that makes it easy to track virtual currency costs.

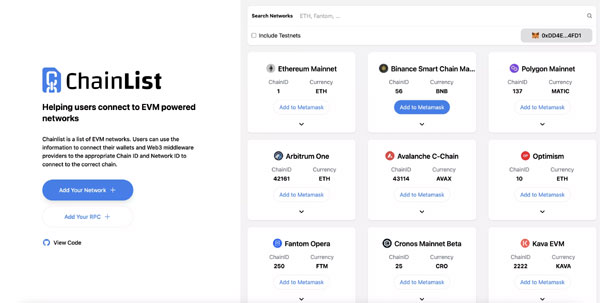

Pera Wallet

Pera Wallet is the top crypto wallet that supports ALGO. The developers at Algorand developed it as an official wallet for Algo. Because of the involvement of Algorand, the wallet experiences continuous updates and growth. Hence, users who utilize the Pera Wallet always remain new. Updates connected to Algorand will take some time to reach users utilizing other wallets.

Best safety, speed, and ease are the features that describe the wallet best. About 4 seconds each second is its lowest speed. You must ensure that your asset is secure using the plenty of features offered by the wallet.

The help with hardware crypto wallets is one of the best features. You can use the supported Ledger Nano X wallet to store your private keys offline. A wallet is a great tool for ALGO stakes or trading. It’s an ALGO-compatible wallet, which minimizes risk levels.

MyALGO Wallet

Rand Labs, an organization developed for the advancements of Algorand, has developed MyALGO Wallet, particularly for ALGO. The easy-to-use interface of the wallet makes it effective for every user. The interface must enhance the effectiveness and security of Algorand traders. For browsers, the MyALGO wallet is best. Users can access the wallet via a web browser via Windows, Mac, Linux, iOS, or Android devices.

MyALGO wallet doesn’t jeopardize user security when it comes to protection. Users can release transactions with two signatures, so multi-sign crypto wallets are safe. Hence, users can secure their assets using MyALGO.

The focus of the teams is on Algorand technology. That’s why wallet users can easily benefit from the recent Algorand network updates.

Is Investing in Algorand (ALGO) a Good Idea?

Because of the high-performance, low-price blockchain platform that allows developers to generate dApps (decentralized applications), ALGO is a good investment. Algorand has the best group of knowledgeable creators and many partners, which provide the project some reliability. Algorand is the best investment option for users seeking a long-term hold.

Also Read: 13 Best Solana Wallets of 2023

Conclusion

In the above guide, we have covered the five best wallets to store the ALGO tokens and reap the advantages of staking them. Simplicity, safety, and in-wallet exchange are some of the best features shared by each wallet. Remember to stick to wallet safety no matter what Algorand wallet you use. You must keep the seed phrase in a safe location.

-

How to Buy Crypto Without KYC Verification

In several ways, KYC (Know Your Customer) has nearly become synonymous with digital currency- basically, the majority of the crypto platforms these days request users to validate their identity before providing them access to their service. So now the question is can users bypass KYC authentication to purchase, swap, and trade cryptocurrency? Continue reading to find out.

Understanding KYC

Let’s begin with understanding KYC and why it is so common in the virtual currency world.

Know Your Customer, or KYC is a set of regulations designed to assist financial institutions in validating the identity of their users. Also, the institution can use it to measure the financial capability of a user and possible risk factors.

KYC authentication can require the following:

- Identity verification (government-approved ID such as passport, driving license, etc.)

- Address validation

- Biometric or facial scanning

- Mode of payment validation

KYC is usually completely automated. In the majority of cases, it only takes a few minutes for a device to check whether the customer is a real human being and whether the details he provided are correct. However, in case of a suspicious transaction, KYC can take a little longer, but these cases are rare and don’t affect 95 percent of customers.

Why Do Crypto Trading Platforms Insist on KYC?

As the digital currency has become more famous and mainstream, theft and money laundering cases have increased. KYC responds to that and the rising demands of regulators, particularly Western ones.

KYC protects cryptocurrency exchanges and other institutions from scammers wanting to acquire illegally earned funds. Also, it assists governments in tracking stolen funds and managing taxation. These things are essential for keeping the digital currency industry secure and crucial if cryptocurrency ever becomes mainstream.

Even though with KYC, virtual currency is much more decentralized and private than fiat assets, many users like leaving no virtual footprint. The validation procedure is an extra step users must take before starting crypto.

Fortunately, some methods exist to purchase and trade crypto assets without KYC.

Top No-KYC Digital Currency Exchanges

Following are some of the simplest methods to buy cryptocurrency without KYC.

P2P Trading

Peer-to-Peer (P2P) trading is one of the simple and reliable ways to buy digital currency without KYC. These crypto platforms connect sellers and buyers without involving in the transactions.

However, peer-to-peer platforms have a few limitations: they are less flexible regarding the kind of cryptocurrency one can receive, longer transaction time, and lower liquidity. There is always a risk of cheating, so users must check a seller’s reviews before making contact. In-person cash payments are the most secure mode of payment.

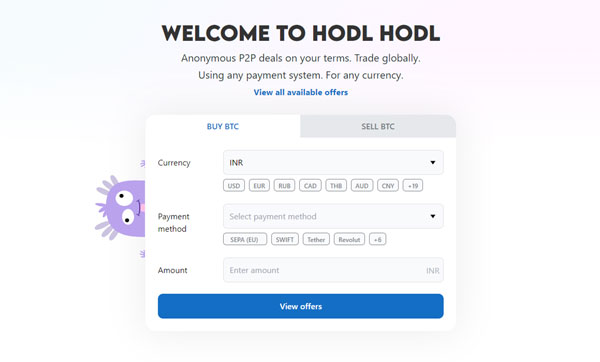

HodlHodl

HodlHodl is a non-custodial P2P platform that eases transactions between traders by providing them with a multi-signature wallet. They comparatively have a high fee of 0.6 percent but are split between the receiver and sender. Remember, they only work with BTC.

Bisq

Bisq is a fully decentralized P2P platform that connects cryptocurrency sellers and buyers without KYC. Part of the software arranges P2P users in a trustless yet safe and transparent way. The platform is also non-custodial and doesn’t keep its users’ funds, whether crypto or fiat currency.

Digital Currency Exchanges

Even though many cryptocurrency exchanges have some kind of KYC built in, it’s not a need, and most users will never need to pass validation. Centralized exchanges remain the simplest and most convenient way to obtain cryptocurrency and one with comparatively low trading fees.

KuCoin

Even though the KuCoin crypto exchange advertises it’s a platform without KYC, it is not. Although they do not need KYC to buy crypto, users still must pass authentication to move their assets. KYC is important to move above 2 BTC a day.

Changelly

Changelly doesn’t sell digital currency directly; instead, it does it through its trusted fiat providers. Each of them needs KYC validation. However, users can still purchase USDT or other cryptocurrencies on a Peer-to-Peer platform and use Changelly to swap it with any supported digital currency.

Digitex

Digitex is the best virtual currency exchange for users seeking unverified purchases. The platform removed KYC validation in 2020.

CoinEX

CoinEX is a famous no-KYC crypto exchange that provides margin and spot trading, along with trading on perpetual contracts. It offers many virtual currencies and tokens, such as its distinctive CET coin. Using CET while trading has benefits when it comes to commission fees. When using this exchange, there are fee triers for large trading volumes.

LocalCryptos

LocalCryptos allows users to purchase and sell virtual currency using non-custodial crypto wallets and a self-custodial escrow system, all backed by smart contracts. Non-custodial exchanges do not keep the private keys of their users. Being a Peer-to-Peer trading site, LocalCryptos does not have transaction limits, but users can have two offers for each combination of country, mode of payment, and kind at any given time.

Local Monero

LocalMonero is likely a widely-used and well-developed Peer-to-Peer Monero exchange in the Monero (XMR) community without KYC checks. Even though heavy in its restrictions on many digital currencies users can trade in, the platform allows users to initiate trade directly with another user. This makes the procedure quick and lean because the corporate overhead is absent.

Being a P2P crypto exchange, LocalMonero has zero transaction restrictions, even though there is a minimum trade restriction.

Also Read: 13 Best Solana Wallets of 2023

Decentralized Exchanges

While DEXs (decentralized exchanges) usually do not need users to generate an account or pass verification, they do not provide direct cryptocurrency purchases. Users can purchase digital assets on these platforms through stablecoins such as USDT or Tron.

dYdX

The dYdX DEX operates on the ETH network and enables users to trade tokens without a third-party intermediary. Unlike several DEXs, dYdX allows users to launch leveraged trading positions, which means users can trade on margin and add collateral. The platform doesn’t need users to do KYC.

Uniswap

Uniswap, the biggest and leading DEX, has not applied the KYC validation procedure. The exchange also receives support from its token UNI, which comes in the top 20 tokens by market capitalization.

Other Alternatives

There are some alternative ways to buy digital currency without KYC for those who do not wish to use an exchange.

Bitcoin ATMs

Users can use BTC ATMs to purchase desired virtual currency without KYC. Note, however, that a few of them ask users to go through KYC validation. Also, they have higher trading fees and are under CCTV surveillance, which makes these ATMs less private, even with KYC.

Direct P2P

Purchasing cryptocurrency directly from another user without an intermediary is the best way to bypass KYC verification. You can purchase from your colleague, friend, or like-minded user found on some discord server.

Trusting someone you do not know is difficult, particularly when there are zero reviews. Still, this method is worth considering if you have friends in the digital currency community. Just ensure to never send the assets to someone you do not trust, and never transact big amounts unless there is some kind of guarantee.

Benefits of Using Non-KYC Crypto Exchange

Below are some of the advantages of using a non-KYC digital currency exchange.

- Ease of Use: The non-KYC cryptocurrency exchanges are best for operating a hardware wallet. If you have one, handling the cryptocurrency becomes simpler and more secure. You can transact without KYC.

- Safety or Privacy: Not all need another financial organization or platform to follow their assets. Non-KYC virtual currency exchanges provide users the option to stay anonymous. A few provide branded cryptocurrency cards for daily use.

- Low Trading Fees: The non-KYC exchanges take lower fees than the popular ones in the crypto market.

- High Performance: Non-KYC exchanges ensure a rapid, secure, and convenient trading environment.

Frequently Asked Questions

Que: Are non-KYC crypto exchanges secure for trading?

Ans: Non-KYC digital currency exchanges are less safe than the platforms with KYC. However, it does not mean that non-KYC exchanges are not secure: users must be more careful when choosing a platform.

Que: What factors can trigger KYC?

Ans: It depends on the platforms and their policies. Following are a few reasons:

- If one user generates several accounts with one-time-use email accounts.

- If a user uses a suspicious crypto wallet address.

Que: Why do users wish to bypass KYC?

Ans: Many crypto enthusiasts want to bypass KYC verification to stay anonymous in the digital currency industry. Non-KYC exchanges allow crypto users to handle their private keys. It confirms that they do not interfere with users’ funds and transactions.

Also Read: How to Install MetaMask Wallet: A Step by Step Guide

Conclusion

Non-KYC cryptocurrency exchanges are those platforms that do not validate user identity. These exchanges allow users to bypass this process. Users can generate an account without KYC, but a few can have transaction restrictions. Digital currency exchanges are high-risk and offer a few non-KYC platforms to restrict transactions. For instance, they can restrict the everyday transaction limit. Read the above guide to learn more.

Source: https://hariguide.com/how-to-buy-crypto-without-kyc-verification/

-

How to Log Into My PayPal Account

With the increasing need for virtual financing, if you also wish to become part of it, you can do it easily as the massive digital platform is accessible in the market. But you must recognize the fact that because of the increasing cyber threats, selecting a secure and opt online platform isn’t a cup of tea for all.

Considering this, we will carefully explore the famous payment platform, PayPal. You will know about each aspect of the platform to get an idea of what PayPal’s online payment platform is and how to use it.

Understanding PayPal

PayPal is a well-known and fully-fledged online payment platform that permits individual customers and businesses to transfer and receive funds online safely. Established in 1998, the platform has evolved into the most widely used system worldwide, with 350+ million users in over 200 markets.

The platform processes about 41 million transactions daily: up 20.58 percent from 2019, with estimated processed transactions of 34 million every day. After connecting PayPal with a debit/credit card, or bank account, users can use it to initiate e-commerce purchases. Users can access it through a mobile app, the web, or in person and Carter as a mediator to keep the bank details safe.

Also Read: Top 5 Investment Apps for Beginners in 2023

How Does PayPal Payment Platform Work?

To utilize the PayPal online payment platform, users must set up an account by submitting their name, email account, and a mode of payment like a credit card or bank account. After creating the account, they can use PayPal to initiate online purchases, transfer assets to their family or friends, and receive payments.

When executing an online payment with the PayPal platform, the recipient won’t see your financial data because PayPal serves as an intermediary between the purchasers and the seller. Instead, users should sign into their PayPal account and choose the desired payment method. The seller obtains the payment but can’t see your bank or card details.

Also, PayPal provides extra safety features, like seller and purchaser protection, which can protect against disputes and scams.

How to Create PayPal Account

To create an account on PayPal, you must go through these easy directions:

- First, move to the official PayPal website using the URL https://www.paypal.com/.

- Then, you should locate and press the Sign-Up button on the home screen.

- On the sign-up page, provide some important information, like name, email account, and address.

- Generate a unique password and security questions to protect your account.

- Next, you must add a desired mode of payment, like a credit card or bank account.

- After this, specify additional details, such as the social security number, to validate your individuality.

- After verifying your identity, you should check and accept the Terms of Usage of the service.

- Lastly, review all the details and confirm the account setup.

- All done; you have successfully generated your PayPal account.

Steps to Access an Account For PayPal UK

To perform the PayPal through your smartphone, ensure you have the PayPal login credentials and install the PayPal mobile app.

- Firstly, you should launch the PayPal app on your desired device and tap on https://www.paypay.com/signin URL.

- Specify your registered email account and password carefully on the Sign in form.

- After this, navigate and hit the Log-In tab to enter your account.

- Note: if you’re not a resident of the UK, you can switch countries by navigating to the My PayPal account settings section.

How to Troubleshoot the PayPal, not Working Issue?

If you are encountering problems with signing into your PayPal account, some potential reasons are creating the issue. Firstly, you may be using incorrect sign-in credentials. Confirm you are providing the email account and password precisely. If you have forgotten the login password, you can access the password reset feature of PayPal to retrieve it.

The technical glitches with the PayPal website or smartphone app can cause login issues for you. In such a situation, you can clean your device’s cookies and cache history or sign into your PayPal account from another network or device.

Advantages of PayPal

There are several reasons behind the popularity of PayPal payment services. Some of the reasons that make PayPal reliable are:

Top-level safety

PayPal has dedicated itself to purchasing security since its establishment. The platform keeps the users’ financial data encrypted and safe, no matter what website users use. Having a PayPal account is like a virtual wallet. The system keeps the financial data on an encrypted network. PayPal also provides email confirmation for transactions and optional 2-FA logins.

Discounts and bonuses

PayPal allows users to link their different credit cards to one account. They can earn rewards points for purchases on their different cards. Also, the users can take advantage of shipping discounts. PayPal provides a free shipping service with extra discounts on UPS and USPS shipping labels.

Global Business

A PayPal account opens multiple doors for international commerce, whether the user is a single customer or an enterprise firm. Approved in over 200 nations and regions, it always permits users to pay in their desired currency.

Also Read: 13 Best Solana Wallets of 2023

Conclusion

PayPal offers a safe and convenient way to receive and initiate payments online with banking services. Users can easily access these services by creating a PayPal account. If you encounter any problem while setting up or accessing your account, and the fixes mentioned above don’t solve your issues, feel free to contact the PayPal customer support team for assistance.

Source: https://hariguide.com/how-to-log-into-my-paypal-account/

-

Top 5 Investment Apps for Beginners in 2023

There wasn’t a better time for the new investors to invest in the stock market. Development in algorithmic trading and technology over the last few years has enabled new investment brokerages and apps to emerge. Most of the brokerages and applications are free for U.S. users. In this guide, we have outlined the top 5 free investment apps and platforms.

Let’s begin with free stuff. What sort of promotions do the brokerages provide? All of these applications have different uses. For instance, M1 has dividend investing, whereas Webull has active traders.

M1 Finance App

M1 Finance is a new investing application enabling users to automate their investing 100 percent for free. They are a hybrid between a brokerage and a robo-advisor.

Investors can invest in lots of stocks and ETFs with the M1 platform. After building a portfolio and adding funds, users can sit back and automatically permit their portfolio to be rebalanced by the M1 Finance app. You should continue the contributions. M1 will put your stock market portfolio on autopilot.

M1 Finance platform functions when users generate a portfolio known as a pie. Users select the particular ETFs and stocks that make up the pie in each pic. For instance, users can have a pie of 50 percent Netflix and 50 percent Facebook stock.

Users can have infinite pies on the M1 Finance app and the option to place hundreds of holdings in one pie. For instance, users can have an income and growth pie on M1 Finance.

M1 Finance also provides expert pie generated by safety professionals on the platform. M1 is a platform that provides this service on an entirely free investing application. These pre-built pies serve specific investment goals. Investors can invest for their retirement, follow particular sectors and industries, and follow the desired hedge fund managers.

Investment Pies

Pie investment via M1 Finance enables users to manage a diversified portfolio even with a small investment account.

One of the issues users have encountered for years is having a diversified portfolio without having thousands of dollars to invest. M1 Finance has made a solution by enabling users to invest with fractional shares.

By buying as small as 1/10,000th of the share, M1 Finance enables users to remain completely invested.

Dynamic Rebalancing

This is the most useful feature of M1, allowing users to ease their investments. When users add funds, the M1 Finance platform will purchase whatever they are underweight. When users take out funds, M1 Finance sets off whatever they are overweight in.

So, M1 purchases low and sell high on the users’ behalf. Dynamic rebalancing permits users to add and move funds knowing that users won’t have to purchase or sell positions themself actively.

In-build Tax Efficiency

M1 Finance enables users to lower their tax liability by utilizing tax-efficient plans when selling investments. M1 Finance is a free investing platform that provides a tax-efficient selling plan.

Webull App

Webull is a renowned commission-free option, stock, and ETF trading application that is a more vigorous version of Robinhood. Well is a great option for those seeking a research-oriented, dynamic interface. Its features benefit users, like research agency ratings, technical indicators, free margin trading, financial calendars, and short selling.

With quick access to research tools, live data, and margin, Webull has created the best platform for active users.

Webull app is ideal for intermediate users who have experience with the stock market. Beginners may find the information overload. If you have some experience, Webull provides you with all the important data you will require.

Technical Indicators

Webull has plenty of technical indicators accessible on the platform. Users can select from technical indicators like relative strength, moving averages, etc.

Another important function is candlestick charts. Users can switch between general candlestick charts and line charts in the app.

Digital Trading Simulator

Webull has a helpful feature known as a virtual trading simulator. This feature allows users to build a digital portfolio with fake currency to test the strategies before risking traditional currency.

This is the best feature for beginners, who may require to gain investing knowledge and learn how before investing traditional currency.

Smart Alerts

Webull allows users to set alerts for multiple holdings. The platform sends users alerts when a cost level hits or the rate of changes has hit the defined level. Also, alerts for changes or volume levels can help users put stock in the short term.

Margin Trading

Webull enables margin trading on the platform for particular users. Users should have the lowest account balance of 2,000 dollars for margin trading approval.

Robinhood App

Robinhood app is user-friendly and aims at beginners seeking to save funds by avoiding commission fees.

Robinhood enables users to trade ETFs, options, digital currencies, and stocks commission free. Robinhood has a simple user interface and offers a better user experience for beginners.

After using Robinhood, you will find that this platform has become very restricting. It is simple for beginners; they will likely outgrow it in a couple of months. The absence of fundamental/technical metrics and charting is a general complaint among users. Robinhood is an easy-to-use platform.

Commission Free

Robinhood enables users to trade options, virtual currencies, socks, and ETFs for free. Investors can save funds on fees. This is particularly helpful for active users who make frequent trades.

Easy-to-Use Interface

Robinhood is user-friendly and not overwhelming like others. This benefits users who have just begun and need a secure and simple-to-use platform.

For users seeking to conduct research and make trading strategies, Robinhood is worth considering.

Moomoo App

Moomoo is a secure and advanced trading application that customs shorter-term users. The app offers a notable amount of information and research that users will find useful. The new traders might find this app intimidating. The user interface is more complex than user-friendly apps such as Public and Robinhood, but professional users may find it what they seek.

Users can buy ETFs, options, and stock contracts in the app. Also, the users can execute short sales and initiate purchases on margin which is beneficial according to your trading strategies.

Moomoo also provides paper trading for beginners or those who wish to get a feel of the platform before putting their funds on the line. With paper trading, you will get 1,000,000 dollars in fake currency to practice trading strategies.

Improved Features for Users

As a trading platform, Moomoo provides advanced features in which traders will find notable value. On the platform, you can access increased-hours trading. This will enhance the trading window. Remember, the markets are ideally more volatile outside of normal hours.

Also, the users can benefit from Level 2 market information without additional cost. This gives users more data on the purchasing and selling activity of a specific stock and is helpful for users seeking to take benefit from short-term cost movements.

Public App

A public app is a social investing application that makes it easy to own the companies users believe in with the desired amount of funds. It aims to make investing educational, inclusive, and fun.

Professionals developed the Public app to allow members to purchase slices of ETFs and stocks, learn from the transparent community of financial professionals, and follow interest-based themes.

Users can invest in funds and stocks commission free. It is distinctive that users can follow other inverters, exchange ideas with investors, and check their portfolios.

Presently, the app doesn’t have premium features that have a fee, but as they introduced products to the platform, they can take a particular subscription charge. Public importantly converts the stock market into a social endeavor, enabling users to become part of a community to share wisdom.

Users can begin by purchasing desired stock with zero minimum required. One can buy micro amounts of stock for 5 dollars.

Free Stock Slice

The Public app gives users a free 10-dollar stock slice during sign-up. There is no lowest amount to receive this stock. Also, you can select the stock you wish to obtain from a collection of leading companies such as Amazon.

Also, users can gift stocks to their friends for free. You can choose the desired stock, send it through email or tweet, and your friend will get about 50 dollars of free stock. To redeem stock gifts, your friend should sign up for Public.com. Public designed stock gifts to motivate new users to begin investing, so the existing Public users aren’t eligible to obtain gifts. Users can transfer stock gifts to a U.S. citizen above 18. You can gift as many as you want; the only restriction is one gift obtained per person.

Another advantage for users: Publick features a watchlist so investors can monitor companies that interest them and check the news stories about them.

Also Read: 13 Best Solana Wallets of 2023

Conclusion

If you are new to the investing world, the foremost decision you must make is what investing app or platform to begin investing with. There are many brokerage platforms to pick from, each providing different services. However, the deciding factors depend on your preferences and priorities. The above guide can help you to understand the top 5 investing apps in detail and make your decision easy.

Source: https://hariguide.com/investment-apps-for-beginners/

-

Token vs Coin – What’s the Difference?

Although users sometimes use coins and tokens interchangeably, they have different meanings. They might not appear that different initially, but they often serve different purposes. Identifying the virtual coins and tokens apart is vital for digital currency users. So, let’s check out the differences and which is a better investment option.

Understanding Crypto Coin

Coins are virtual assets that consist of their fundamental protocols and blockchains. They function in a way that is almost the same as how fiat assets work and provide the best payment methods or keeps of value.

Users normally think of coins when they encounter or see the term cryptocurrency. The leading digital currencies are Ripple, Ethereum, and Bitcoin.

What is the Purpose of Crypto Coins?

When Bitcoin came into existence, people thought it replaced traditional fiat assets. Like other cryptocurrency coins, Satoshi Nakamoto designed BTC to function in the same manners as traditional currencies, which means users can use it for different things normally with USD or EUROS, including: Storing value, buying goods and services, swapping with other currencies, and sending to others.

Together with the traditional uses, a few virtual coins can benefit from smart contract technology to provide extra features. For instance, an altcoin DASH works as a digital currency but also provides users the capacity to participate in a DAO (decentralized autonomous organization).

List of Leading Crypto Coins

Following are some of the most popular virtual coins.

- ETH (Ether): ETH is a leading cryptocurrency coin and more than a digital currency. Because of its development and execution of smart contracts, ETH has become home to many NFTs and blockchain projects.

- BTC (Bitcoin): Launched in 2009, BTC is the world’s foremost and most popular cryptocurrency coin. BTC’s head start has enabled it to become a valuable digital currency.

- ADA (Cardano): ADA is a decentralized blockchain and open-source platform that was among the foremost to run on a PoS (Proof-of-Stake) consensus, gaining its reputation as a green digital coin. Charles Hoskinson, the ETH co-founder, launched it in 2015 and facilitated P2P (peer-to-peer) transactions with the coin ADA.

About Crypto Token

Unlike crypto coins, tokens do not feature their blockchain. Rather, they work on other digital currency networks. Different institutions and projects usually develop them on top of other chains.

Since they utilize the same blockchain, virtual tokens, and their initial coin sometimes share a few similarities, and they are compatible. However, crypto tokens are not a payment method or storage of value: they’re a separate asset type.

Some blockchains support the development of tokens. Ethereum (ETH) is the leading one, consisting of the generally used token standard, ERC-20. Each token depends on a technology known as smart contracts and comprises four defining features. They must be:

- Trustless: Tokens do not depend on any central authority because they are decentralized; instead, the regulation determined in its protocol utilizing smart contracts runs them.

- Transparent: Users can check and validate the transaction information and the regulations that govern the token.

- Programmable: Developers use smart contract technology to create and launch the tokens. They help program and outline the tokens’ features, rules, and purposes.

- Permissionless: Tokens must be available to each user. They don’t need any specific credentials from the users.

Purpose of Crypto Tokens

Users can use the tokens like they use coins, as it has speculative asset investment. However, tokens have real purposes, unlike coins, representing physical currencies or even particular utilities or features.

Crypto tokens permit cryptocurrency projects to provide some of the users access to things such as dApps (decentralized applications), exclusive merch sales, blockchain games, and others. They allow users to participate in protocol upgrades and different governance proposals.

Also Read: Coinbase vs Cash App: Which Is the Better Option?

List of Different Kinds of Tokens

Developers have divided the tokens into sub-groups based on their purpose and design. Below are the common ones.

NFTs

Non-fungible tokens (NFTs) are the most popular list of tokens. They don’t serve any practical purpose, and users treat them as luxury items. Each NFT shows a different asset.

NFTs are virtual certifications of ownership. They show distinctive virtual assets like videos, art, or tweets. Like other tokens, the developers of NFTs use smart contracts technology.

Security Tokens

Security tokens are similar to external assets that users can trade as securities. These tokens are the tokenized version of stocks, bonds, property, and others. Due to this, different financial regulators manage their issuance and swap.

Sometimes, the security tokens only show a share or stake in the associated digital assets. Its users can get special advantages, like a portion of the profit or the capacity to partake in a few decision-making processes. Tokens can offer an instant settlement, market participants with transparency, and other advantages of crypto.

Presently there are two kinds of security tokens: asset-powered and equity tokens.

Utility Tokens

Utility tokens users can access goods and services. Sometimes the tokens provide users the right to connect to a platform or a virtual product; otherwise, they offer a discount on fees or free access to that platform. Utility tokens are the backbone of many dApps (decentralized applications) and other decentralized finance (DeFi) projects. As an outcome, having a utility token can give users advantages far beyond monetary ones.

Governance Tokens

As the name suggests, governance tokens allow users to participate in governance decisions. Usually, the decisions get implemented automatically as a system functions on smart contracts. However, in a few cases, the project managing team must manually carry out them.

Governance tokens empower the users; hence, design projects that utilize them are notably less centralized.

Examples of Tokens

There are many tokens available in the crypto industry. Non-fungible tokens include famous collections such as Bored Ape Yacht Club or the world’s foremost tweet. Maker (MKR) is the top example of a governance token.

ETH blockchain-based tokens are the most trusted and widely used. However, a few other networks are beginning to captivate more developers, particularly as Ethereum gas fees continue to increase. Solana and Tron are other leading chains with smart contract features and get selected by most token developers.

Some virtual currencies have separate token versions on various blockchains, for instance, USDT, a stablecoin.

What Distinguishes a Token from a Coin?

The key difference between crypto and coins is that they have their blockchain, whereas tokens don’t. Also, developers have created tokens with the real purpose in mind, so the cost of the token depends on market speculation and supply and demand, even though this is the case for a few coins, particularly those that have additional features such as ETH or one that users can use as payment in a few places such as Bitcoin.

Presently there are thousands of tokens in circulation-much more than virtual coins. This is because tokens are simple to create, as they do not require coding a new blockchain to create them.

Users must know the difference between a crypto coin and a token as it assists them in better understanding the digital currency they are investing in or trading. Eventually, users can determine whether a digital currency is a token or coin online.

Conclusion

After reading the above tutorial, you must have understood the difference between crypto tokens and coins. Now the question of purchasing tokens or coins depends on your goals. With less fees, you can buy both from different cryptocurrency exchanges, such as Crypto.com.

-

Coinbase vs Cash App: Which Is the Better Option?

Coinbase and Cash App are two top options for a secure and user-friendly way to buy virtual currency. Both make it straightforward to invest in digital currencies, but apart from that, the platforms are similar.

Users can purchase and sell BTC (Bitcoin) via Cash App, a stock broker that works as a payment application. The leading crypto exchange is Coinbase, available for beginners and professional investors.

Fee Structure: Coinbase vs Cash App

Coinbase charges lower trading fees than Cash App, which is an essential benefit if you are looking to invest in crypto assets regularly.

Cash App calculates the fee amount when the user initiates a purchase instead of making it public. Before confirming your transaction, you should consider the cost. On 100 dollars or fewer purchases, costs are usually higher than 29 percent. Bigger purchases result in low fees, but they’re still more than what the best virtual currency exchanges take.

It is a bit challenging to know about Coinbase fees. This is because of the different fees based on whether users use its easy or advanced trading option.

The correct option, with costs differing from 0 to 6 percent, is the advanced trading tools of Coinbase, which it created to replace the Coinbase Pro exchange. According to the maker-taker model, the fee depends on the user’s trading volume. By extension, the Coinbase platform takes a taker fee when one order is instantly filled by a second order on the order books and the maker fee if an order is not.

Coinbase has yet to disclose the fee structure for simple trading options. Based on a particular amount, smaller trades require a flat fee that differs from 0.99 dollars to 2.99 dollars. Trades of 205 dollars and more have a variable fee normally under 1.5 percent.

Also Read: 13 Best Solana Wallets of 2023

Supported Cryptocurrencies: Coinbase vs Cash App

Coinbase platform notably outperforms Cash App in the digital currency selection.

Regarding selection, Coinbase is one of the top digital currency exchanges. It provides over 150 virtual currencies and is continuously adding more. After creating a Coinbase account, users can trade various cryptocurrencies, such as stablecoins, market leaders, and some smaller currencies. Also, Coinbase offers cryptocurrency staking, which allows users to profit from various digital currencies.

Currently, Cash App only sells BTC. That isn’t a big deal if you seek a stock trading payment app that enables users to buy BTC. Still, a reliable cryptocurrency exchange is a better choice if they are serious about investing in virtual currencies. There are numerous leading digital currencies you cannot purchase on Cash App, such as:

- Cardano (ADA)

- Polkadot (DOT)

- Ethereum (ETH)

- USD Coin (USDC)

- Solana (SOL)

Crypto Wallets: Coinbase vs Cash App

Users can initiate transactions and receive crypto (only BTC, in Cash App) using their wallet address via the custodial wallets provided by Coinbase and Cash App. Also, considered as hosted wallets, the platform itself manages these blockchain wallets. If you need full control, move the digital currency to a non-custodial crypto wallet.

Also, the Coinbase platform offers a non-custodial wallet. You don’t need to register an account with the Coinbase exchange to use it. It is a reliable wallet option that supports storing digital currencies and other virtual assets such as NFTs (non-fungible tokens) and storing fiat assets.

Safety Measures: Coinbase vs Cash App

It is secure to purchase and sell crypto on Coinbase and Cash App. Among the two, Coinbase provides insurance and stores most of the crypto assets offline in cold storage, providing its users with the best security. It is more challenging to steal digital currency kept offline.

Cash App safeguards users’ financial data and sensitive information using encryption and cutting-edge fraud detection technology. Here are some major safety features of Cash App:

- Users obtain a one-time sign-in code every time they access the Cash App.

- Users can enable a safety lock, so Cash App requires their passcode to initiate transactions.

- One can also turn on account alerts, which drop text messages, notifications, or emails whenever there is any activity on the account.

- Cash App keeps the BTC from users in cold storage, in part. Although, the part stored in cold storage is not explicit. Its official website shows Cash App utilizes an offline or online wallet system.

One of the renowned and secure crypto exchanges is Coinbase. Following are some of the safety features it has in place to secure its users and their assets:

- Coinbase users should allow 2-FA (two-factor authentication. A reliable password and a code obtained by the account holder on their phone are two examples of the identification users must use to access their account with 2-FA.

- Coinbase keeps most assets (about 98 percent) in cold storage.

- For the digital currency it keeps in hot wallets (online), Coinbase has created an insurance policy.

- Coinbase provides FDIC insurance to U.S. user accounts to cover cash funds. This kind of insurance provides coverage of up to 250,000 dollars for each user.

User Support

Coinbase provides customer service via email between 24 to 72 hours. For general queries, it also has a sizable FAQ.

Via the app, users can contact customer service (tap on your profile and choose the Cash Support option). Exceptional user service isn’t specifically well-known for Cash App. Numerous users complain about getting their accounts disabled for no evident reason, with no user support assistance to resolve the problem.

Reputation: Coinbase vs Cash App

Coinbase enjoys great trust and reputation as a verified and regulated company with popular V.C.s as investors, an immaculate track record, and a transparent team.

Being a San Francisco-based BTC organization, Coinbase should abide by each federal and state rule and regulation in the United States. Following are a few of the laws, regulations, and regulatory bodies that Coinbase complies with:

- Coinbase complies with each applicable state’s rules and laws governing currency transmission.

- It sticks to Bank Secrecy Act needs.

- It adheres to the USA Patriot Act.

- Coinbase has Currency Service Business registration with the FinCEN organization.

On the other hand, Cash App has received a license from state currency transmitter licenses.

It is subject to the institution’s supervision, enforcement obligations, and rulemaking when it uses services such as ACH. This could involve the EFTA (Electronic Funds Transfer Act). The (FTC) Federal Trade Commission and the Consumer Financial Protection Bureau (CFPB) regulate EFTA.

Conclusion

Coinbase and Cash App selection depend on your requirements and preferences, as both platforms are dissimilar. Coinbase is a great choice for investing in digital currencies. The widest selections of digital currencies, informative materials, cutting-edge trading tools, and top-level safety are all available. Trading commissions are reasonable if you wish to use sophisticated trading tools. Overall, Coinbase provides all the services you can expect from an exchange.

If you are seeking a user-friendly stock trading application that lets you purchase and sell Bitcoin, Cash App is worth considering. Because of the reason that, unlike the Coinbase exchange, it is not only dedicated to digital currencies; it has more restricted crypto support.

-

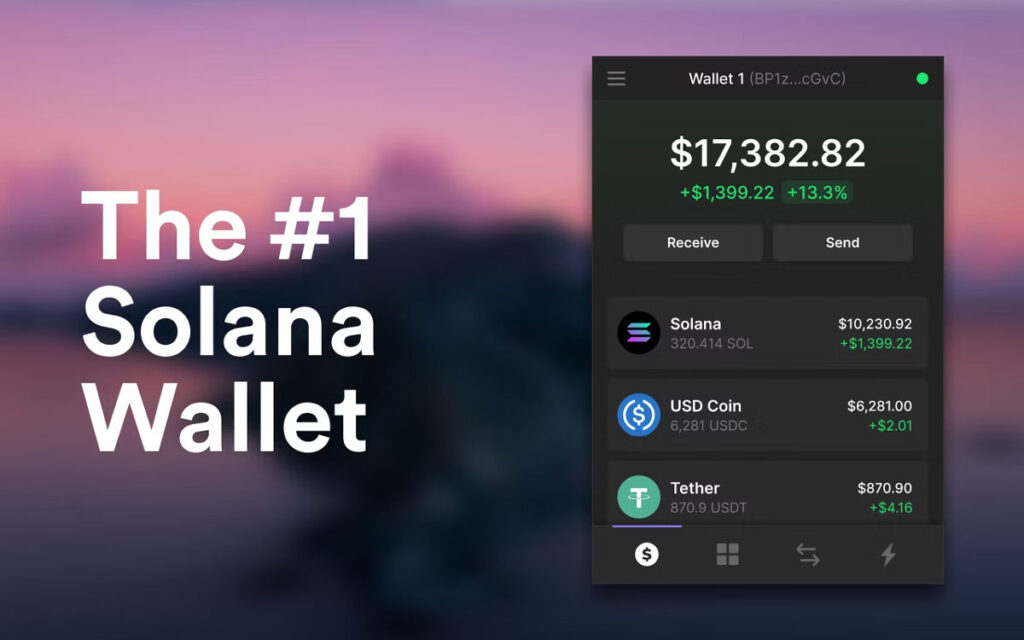

Phantom Wallet Review: Solana Crypto Wallet 2023

Phantom allows users to easily and securely stake, exchange, transfer, and store tokens and NFTs (non-fungible tokens). Phantom Wallet utilizes bank-standard encryption to protect its users’ private keys and assets because safety is the foremost priority when developing the product. So let’s check if the wallet fulfills your needs by reading this guide.

Introducing Phantom Wallet

Phantom is a self-custodial virtual wallet for the Solana blockchain. It is presently available as a browser extension for Brave, Firefox, Opera, and Chrome browser downloads and is almost identical to its Web3.0 substitute, MetaMask Wallet.

Users can handle their virtual currencies and NFTs, trade, stake, and access DeFi (decentralized finance) apps on the Solana blockchain with Phantom. The beta edition of the team’s support for ETH (Ethereum) will become accessible soon.

Being a Web3 digital wallet, Phantom does not keep its users’ private keys on file but allows users to access them. Like MetaMask, users can connect Phantom Wallet with Ledger hardware wallet.

Phantom is a rapidly-growing digital currency wallet with over two million registered users after a few months of release. In January 2022, Phantom declared that it had earned 109 million dollars in Series B funding led by Paradigm and involved earlier backers like 16z, Solana ventures, variant, and jump digital currency.

What is Solana Blockchain?

Solana is a rapid and highly scalable blockchain in the crypto world. It is popular for supporting many DeFi solutions and its leading SOL token.

Anatoly Yakovenko established the Solana platform in 2017. The team created Solana to process over 500,000 transactions every second using Proof of History to compete with online payment services such as PayPal and Visa.

To allow developers to design decentralized applications (DApps) on the network, Solana is also compatible with smart contracts. As an outcome, Solana can support the lending platforms, operation of DEXs (Decentralized Exchanges), and NFT marketplace.

Does Phantom Wallet Have Fees?

Users should pay transaction charges, and gas fees, for every transaction they perform on the Solana network. The payment needs for ETH transactions on Ethereum or BNB transactions on the BSC (Binance Smart Chain) are comparable. Instead, users will need to pay SOL for Solana.

Hence, users should always have sufficient SOL tokens in their wallets to pay the transaction fees related to staking, transferring, swapping, and more.

What Safety Measures Does the Phantom Wallet Follow?

Phantom is a non-custodial wallet; that’s why the users hold their private keys. Hence, instead of depending on a third party, users are responsible for the safety of their wallets and funds.

The wallet requests users to keep the secret seed phrase containing 12 words with the best safety practice. This secret phrase is essential to restore the wallet if you damage the device or lose the password. Therefore, the phrase plays a vital role in generating a wallet.

Also, if someone else finds your seed words, he will get access to your digital currency holding. So you must record them precisely, in the correct sequence, and keep them safe, far from possible harm.

Phantom Wallet Mobile App

Users can utilize their virtual currency wallet and desired Web3 Applications when on the go with Phantom for iPhone smartphone app. Users can do anything on their desktop, such as receiving, transferring, earning, and exchanging with the Phantom app.

Remember that the app is only available to iOS users via the App Store and is presently unavailable for Android users.

Phantom Wallet and Ledger Hardware Wallet

Ledger is a renowned hardware wallet compatible with Phantom. Simply, users can secure their tokens in the confines of their Ledger device. Trezor, another hardware wallet, presently doesn’t support Solana.

Downloading the app through Ledger Live is necessary before connecting the Ledger wallet. Then connect the wallet by setting up an account.

How to Connect Phantom Wallet with Ledger Wallet

- First, download the Solana App on the Ledger Wallet (ensure to run the updated version).

- Hit the Settings icon on Ledger and adjust Allow Blind Sign to Yes.

- Then, Connect and enter the Ledger device.

- Next, access your Phantom Wallet and tap on the Burger icon on the top.

- After this, hit the Add/Connect Wallet tab and choose the Link the hardware wallet option.

- On the pop-up page, select your Ledger device and hit the Connect button.

- After selecting the desired address, the Ledger device will connect.

- Note: Users can connect Ledger with Brave, Edge, and Chrome. Presently Ledger doesn’t support Firefox.

Tips to Fix Connecting Phantom and Ledger Issues

You can encounter some problems when connecting the Ledger Wallet to your Phantom Wallet. Below are a few suggestions that you can try if you encounter any issues:

- Ensure you haven’t connected your Ledger with another wallet like MetaMask or Terra Station.

- You must close all the apps if you are using any.

- On the Ledger wallet, in the Solana mobile app. Hit the Settings icon and adjust Allow Blind Sign to Yes.

How to Swap Tokens and Stake Solana with Phantom

Swapping Tokens

You can swap tokens on Solana using the Phantom Wallet’s in-built DEX. You can swap between USDC, Solana, Serum, Raydium, and USDT.

Exchanging tokens becomes easy with the in-built DEX, which removes the requirement to move assets or connect to extra decentralized applications (DApps). You only require sufficient SOL to pay the transaction fee, which, compared to ETH, is low.

Staking Solana

The Phantom Wallet permits users to stake Solana in the web application to earn a yield on their digital assets. To stake Solana, you hardly select a validator from the supported ones. Before picking up a validator, it is important to do some research work on each. Users can stake SOL tokens on platforms such as FTX EXchange, Exodus Wallet, and Binance Earn.

Also Read:

How to Add Solana to MetaMask Wallet

How to Add Polygon (MATIC) to MetaMask Wallet

How to Add Tron (TRX) to MetaMask Wallet

How to Add USDC to MetaMask Wallet

How to Add Bitcoin Network to MetaMask Wallet

Conclusion

Phantom Wallet is a fully native Solana wallet different from similar wallets because of its easy-to-use design, vigorous safety features, and huge support for decentralized applications. The Wallet is a notable player in the NFT (non-fungible token) and DeFi space, with plans to widen its reach to ETH (Ethereum) and other networks. If deciding carefully, review the features and benefits Phantom Wallet offers and if it fulfills your needs.

-

13 Best Solana Wallets of 2023

This informative blog describes the features and qualities of Solana Wallet and covers some of the leading ones that support the SPL token standard of Solana. A digital currency wallet is software or hardware that allows users to connect with Web 3.0 dApps (decentralized applications) and receive and send tokens. A Web3 wallet consists of one or more keypairs, which are public and private keys created cryptographically.

Photo by GuerrillaBuzz on Unsplash

Introducing Solana Wallet

Digital currency users can keep, receive, and send SOL tokens via software or hardware, well-known as Solana wallets. On the Solana blockchain, many digital wallets are compatible with a single crypto; on the other hand, hardware wallets support different crypto assets.

As virtual currency depends on the blockchain, Solana hardware wallets don’t store crypto. The hardware wallets provide a storage location for users’ private keys, allowing them to access the blockchain where they have stored their Solana. Users can protect their private keys and stop online attacks with the hardware wallets such as Ledger Nano X.

Solana digital (or software) wallets such as Sollet, SolFlare, and Phantom provide online storage for private keys. These wallets, like a keychain, keep the private keys that give users access to their Solana. The three kinds of Solana digital wallets are mobile, desktop, and online.

The wallets vary from BTC and ETH wallets. BTC wallets don’t support smart contracts, but ETH does. BTC and ETH wallets need specific gas fees for initiating transactions, while Solana takes less than one cent for each transaction.

What Are Solana Wallets?

Solana is a renowned blockchain that utilizes the POS (Proof-of-Stake) consensus protocol that allows a large volume of transactions every second. Also, it permits 50,000 transactions per second to increase the network’s speed, and the transaction cost is extremely low.

Cooperation with different payment systems such as Circle, Digital Assets AG (access to the US stock market and tokenized stocks on SOL network), Chainlink, and digital currency exchanges projects Solana is stepping up among the rivals with a bright future.

Because of its performance and scalability, Web3, blockchain gaming, and DeFi developers selected it to design their projects on Solana.

Top Solana Wallets

We have divided the Solana Wallets into three categories that are Solana mobile-first wallets, hardware wallets supported by Solana, and multi-chain wallets supported by Solana tokens.

Top Solana Mobile-First Wallets

- Slope Wallet

- Phantom Wallet

- Trous Wallet

- SolFlare Wallet

- Glow Wallet

Popular Hardware Wallet Supported by Solana

- SafePal

- Ledger

- Exodus

Leading Multi-chain Wallets Compatible with Solana Tokens

- MathWallet

- Token Pocket Wallet

- Atomic Wallet

- Coin98 Wallet

- Clover Wallet

Significant Features of Solana Wallet

The popular Solana Wallets have at least six features, like good dApp connectivity, user interface design, native staking, and others. Let’s check out all six qualities in detail:

dApp Connectivity

dApps (decentralized applications) construct a huge portion of the Solana (SOL) ecosystem and allow users to interact with them, and users must ensure that their wallet is compatible with Solana.

You need a virtual wallet that supports using DEX (decentralized exchange) to trade SPL tokens or buy NFT (non-fungible token) via the top NFT marketplace on the Solana network.

User-friendly Interface

You can check and trade NFTs, spend, purchase, and sell tokens, and handle your crypto assets with an easy-to-use UI (user interface. Many wallet solutions use different techniques to secure keypairs, manage tokens, engage with dApps, and sign transactions. Solana wallets make this procedure easy.

Mobile Friendly

Only a few mobile crypto wallets function in concurrence with web browser-based wallets. Mobile Solana permits easy interoperability for on-the-go interactions and transactions, like transferring payments to businesses and friends via QR codes and Solana Pay.

Native Staking

Many Solana wallets automatically activate the staking accounts with the user’s wallet address. SOL token holders can earn interest and contribute to network safety by staking the tokens. It removes the requirement of liquid staking protocols or individual validators by enabling users to stake the SOL tokens within the app.

Native Swaps

Contrary to asking users to connect to the user interface of a DEX to exchange tokens, many crypto wallets permit users to exchange SPL tokens from within the wallet natively. Wallets smooth the user experience and enable more functionality in one place by offering in-built swaps to users.

Regular Updates

Most Solana wallets have support teams and active development that ensure a positive user experience, new features, safety, and interoperability. These wallets address issues, work on user feedback, and routinely introduce improved features.

List of Leading Solana Wallets

Following is the selection of popular Solana wallets. Mobile first wallets and browser wallets are some of the great options accessible. The following two sections will describe multi-chain wallets and hardware wallets.

Top Hardware Wallet Supported by Solana

Because of the best safety features, hardware wallets are the safest option for keeping virtual tokens. These wallets ideally support different blockchains, and a few also support the SPL token standard of the Solana network and ERC-20 standards. The two leading hardware wallets supported by SPL tokens are:

Ledger Hardware Wallet

Using SPL tokens in SOL blockchain-based dApps and staking them to earn rewards is the best method to keep them secure in a reliable hardware wallet. Setting up the Ledger Nano X and Nano S hardware wallet and SolFlare web wallet is easy.

To set up the hardware wallet, you should do the following:

- Download the Solana app via the apps catalog in the Ledger Live application.

- Navigate to the Settings section in the Solana app and turn the Blind signing to Yes.

- Generate a new wallet on SolFlare.

- Select Ledger Nano X and tap on the Access tab.

- Lastly, confirm the connection on the hardware device.

Now the Ledger wallet users can check the list of Validators and other information like total stake sum, skipped blocks, number of delegators, and URLs to their websites, by tapping the Staking tab.

SafePal Wallet

SafePal provides users with a safe and user-friendly platform for handling digital assets. This makes it easy for users to store and increase their assets securely.

SafePal is the foremost hardware wallet in which Binance, a leading crypto exchange, has ever invested; it has over 3,000,000 registered users worldwide using its software and hardware wallets, which users can pair and manage via the SafePal App.

Solana token holders can easily swap, manage, secure, grow, and trade without compromising the safety of their funds. SafePal is the best multi-chain wallet similar to Ledger.

Solana Mobile-First Wallets

Slope Wallet

The slope is a self-custodial mobile-first Solana wallet with the lowest transaction fees, a rapid transaction process, and a user-friendly interface. The wallet consists of all the important features, like dApp connectivity, an intuitive interface for representing the Solana NFT collectibles, and support for different devices.

Phantom Wallet

Launched in 2021, Phantom is a well-liked virtual currency wallet for the Solana ecosystem. Phantom wallet users can access virtual assets on the Solana network and store, send, receive, trade, and stake them.

Users can download the Phantom mobile app and browser extension from the official Phantom Wallet website. The wallet is compatible with widely used browsers such as Edge, Chrome, Brave, and Firefox and mobile operating systems such as iOS.

SolFlare Wallet

SolFlare is one of the foremost crypto wallets developed by Solana Labs, also known as the Solana ecosystem. A web and smartphone app are accessible together with the browser extension.

You can trade crypto tokens on both the browser extension and online app, but soon, only smartphone devices will support this feature. Users can connect the wallet with the Solrise investing platform, enabling them to handle their crypto investment from the wallet.

SolFlare uses a 24-word seed phrase for better safety. Also, the shaking system of SolFlare stops users from staking all of their funds, which can help to prevent future problems with accessing staked tokens.

Torus Wallet

Torus offers one-tap sign-ins for decentralized applications users can instantly switch between Facebook, Google, Twitch, Discord, Reddit, or an email account without additional installations. Irrespective of whether your friend has signed into Torus Wallet, you can communicate with Reddit usernames, Discord IDs, and Google emails on the blockchain using Torus.

Torus has modified the web OAuth user onboarding process in cooperation with the Solana network. Now the Solana creators have straightforward access to key management because of the DirectAuth integration of Torus. As an outcome, creators have more hold over how users sign up, sign in, and use the wallets.

Glow Wallet

Through mobile devices, Glow Wallet users can store, receive, send, swap, and stake tokens. It also has some amazing features that make it unique.

The wallet has a safe, seamless, aesthetical user interface and supports Safari mobile and Solana Pay. It is presently only accessible on iOS. Because of the in-built notifications, integrations with different wallets, backups to iCloud, and integration with Safari, Glow Wallet is easy to use.

Top Multi-chain Wallets Compatible with Solana Tokens

The ETH (Ethereum), Solana (SOL), and Ethereum Virtual Machine (EVM)-compatible networks are the different blockchains supported by multi-chain wallets. Solana wallets are the best for handling SPL tokens and other token standards, but they sometimes don’t have the same decentralized application integration support as the native Solana Wallets have. Below is the list of leading Solana wallets.

Atomic Wallet

Atomic Wallet allows users to stake several digital currencies, such as SOL Tokens: In a similar way that users could with the local validator, users can pick a validator and stake their SOL with it. Users will obtain a 7% reward for selecting to stake with an Atomic validator node and over 5% to 6% reward for validators.

Users can use third-party wallets such as Atomic for an on-ramp into digital currency. An On-ramp is a process of buying crypto via the wallet and having it transferred to the wallet. Beginners of the blockchain revolution now have a secure and straightforward way to get involved.

However, the costs are high, but not intolerably high. Users cannot buy all the tokens, like SOL, with fiat assets. You should first buy another token, like ETH or BTC, to get SOL in Atomic Wallet, which you can trade for SOL in the wallet.

Exodus Wallet

Exodus Wallet can hold different kinds of cryptocurrency. It is compatible with Mac, Windows, Linux, iOS, and Android devices. Users get a return on their investment of about 6 percent annually. Also, the users can connect the desktop version of the wallet to the Trezor Model T hardware wallet via the Trezor bridge.

MathWallet

MathWallet is the best virtual wallet with plenty to offer like:

- Math Vault: The mining pool of the wallet. Users can stake SOI in Math Vault, where a few tokens have as high as 30 percent standard APR rates.

- Math dApp: a dApp (decentralized application) marketplace where you can utilize your virtual wallets to connect with services created on popular chains.

- MATHGas: This records how much gas prices are at major chains.

MathWallet supports over 86 blockchains, which run on different platforms such as desktops, smartphones, hardware integration with Ledger, and browser extension.

Clover Wallet

Clover is a multi-asset wallet that users can utilize with their mobile phone or as an extension in the web browser. With the connectivity with the different networks such as BNB Chain, Polkadot, Solana, and Ethereum, the wallet can connect to DeFi (decentralized finance) apps cross-chain without switching between the networks.

Users can wrap, unwrap, send, and receive assets with Clover Wallet without involving any custody. You can also install the wallet and check the source code, as it’s free.

Coin98 Wallet

Coin98 Wallet has provided one of the foremost smartphone apps to support different devices like Google Chrome, Android, and iOS, and there are many versions of Solana decentralized applications. Several dApp categories in the dApp store provide a huge range of apps. Coin98 offers a dApps browser that permits users to switch between networks the wallet consists of.

Many platforms, like a centralized exchange, non-custodial wallets, and others, are accessible to handle the portfolios. Safety is essential to the wallet, providing multiple safeguards to secure users’ wallets.

TokenPocket Wallet

TokenPocket is a secure crypto wallet enabling users to swap digital currencies over blockchains. Being created on the decentralized application (dApp), doorway users can connect the wallet to over 2,200 dApps.

Users can receive, move, swap, and maintain track of transactions via a single interface. They can get updated data about the blockchain industry and the token costs of the market in the news and market section of TokenPacket Wallet.

How are Hardware Solana Wallets different from Solana Software Wallets?

Solana software (or digital) and hardware wallets provide similar functions but are slightly different.

The hardware wallet is generally a device that you can plug into a PC or connect via Bluetooth, which functions like a portable key to access the SOL assets securely from anywhere. The wallet provides an additional layer of safety against cyber threats, phishing attacks, and malware. A hardware wallet can also sign you into different dApps without creating a new account.

On the other hand, software wallets are programs or applications that keep users’ private keys and allow users to use these wallets on PC, smartphones, or tablets. These software wallets create a 12 or 24 word recovery phrase that proves users’ ownership of their Solana.

Tokens Supported by Solana Wallets

Solana wallets such as Phantom support every token available on the Solana ecosystem. Meaning users can keep SOL tokens and SOL-based NFTs in their wallets.

Also, the Solana wallets support other popular digital currencies, such as:

- Raydium

- USDT

- Serum

- USDC

Difference Between Solana Wallets and Ethereum Wallets

Ethereum (ETH) and Solana are at the top in the blockchain world. ETH is more popular among users as it has gained notable traction since its introduction in 2015. On the other hand, Solana is comparatively new and still growing.

ETH uses PoS (Proof-of-Stake), while Solana uses PoH (Proof-of-history). Solana has a top level of scalability by supporting the PoH mechanism, and it permits about 50,000 transactions every second. The newer PoS method of ETH boasts double the transaction abilities at 100,000 transactions per second. Both PoS and PoH have high scalability and are better than PoW (Proof-of-Work) earlier used by ETH.

The Solana crypto wallets provide the capacity to buy NFTs (non-fungible tokens) for zero transaction cost and the least congestion issues. Meaning buying NFTs with the Solana wallets is easier than ETH wallets.

ETH wallets are better if you are seeking smart contract support. Many financial organizations like ETH over Solana. Solana is trying to catch up.

Guide to Select the Best Solana Wallet

There are many factors to consider before picking up a Solana Wallet. Selecting what services you seek and the particular requirements of the wallet depends on you, but here is a list of some common qualities users look for.

User Experience

For users seeking a user-friendly experience, a custodial crypto wallet is a way to go. They consist of more user-interactive functions and a user-friendly layout. Regarding non-custodial wallets, they need technical know-how, which may generate a frustrating experience for users, particularly beginners.

Asset Accessibility

Selecting a crypto wallet that permits users to access their assets is essential to many users. Picking up a non-custodial wallet is best for those interested in maintaining the private keys of their wallets. A non-custodial wallet allows you to retain full control over the keys and assets. While the custodial wallets keep the private keys with a third party, which means they have control over the assets.

Fiat on-ramps and offramps

On ramps allow users to swap their Fiat currency for digital currency. In comparison, offramps enable users to cash out their earnings via virtual currencies by allowing them to sell their assets for Fiat currency.

Safety

Those seeking the most secure crypto wallet must consider a non-custodial wallet. They are safe from cyber threats because you don’t connect them to the internet. Users must confirm the storage of their seed phrases and private keys.

Software or Hardware wallet

One of the important reasons for choosing a crypto wallet is selecting between a software or hardware wallet. Pick a hardware wallet if safety is your priority. Choosing a Software wallet is correct if you need easy use via browsers or apps.

Also Read:

How to Add Solana to MetaMask Wallet

How to Add Polygon (MATIC) to MetaMask Wallet

How to Add Tron (TRX) to MetaMask Wallet

How to Add USDC to MetaMask Wallet

How to Add Bitcoin Network to MetaMask Wallet

Conclusion

Selecting the correct Solana Wallet depends on your intended use and preference. If safety is your foremost priority, go for a hardware wallet. If easy use of apps or web browsers is your priority, choose a software wallet. If you need full control over private keys and funds, choose a non-custodial wallet. In the above guide, we have covered the best Solana wallets so you can follow them for a better idea.

-

Coinomi Wallet – Reliable Cryptocurrency Wallet?

Coinomi’s powerful performance history provides everything users require in a virtual wallet. Coinomi is a leading and trustworthy digital currency wallet that can keep 500+ assets and supports many gadgets. It’s a well-appreciated mobile and desktop multi-asset wallet. We will cover different features and services of the wallet in this guide.

About Coinomi Wallet

George Kimionis established Coinomi in 2014, intending to design safe solutions for blockchain apps. This privacy-centric wallet is compatible with 125 blockchains and accessible in 25 languages. The Coinomi team declares that it will translate its features, services, and applications into more languages to reach more users. The firm has around 20 employees and has yet to announce the outside funding.

Features of Coinomi Wallet

On the project, several professionals united, putting the basic concepts into practice. The essential features of Coinomi are:

Anonymous Use and Storage of Cryptocurrency

The KYC (know your customer) method gets no support. Coinomi has concealed the IP addresses, encrypted the client information, and generated dozens of fictitious addresses.

Optimized Standard Options

The wallet has well-optimized standard features, like an internal swap of virtual coins and transactions.

Integrated Cryptocurrency Exchangers

Coinswitch, Changelly, Binance DEX, and Totle features are examples of integrated virtual currency exchangers.

Simple and Convenient

The simplicity and ease of Coinomi Wallet have attracted many traders and investors. Tools such as market depth, price charts, many settings, fiat currency swaps, chats, news feeds, and more aren’t inappropriate or inessential. Even 2-FA (two-factor authentication) and multi-signatures for transactions are lacking. Everything is straightforward and convenient.

Remarkable Conversion Rate

Executing swap operations is notably quicker when using two swap services simultaneously. Most delays during rush hours last up to a couple of minutes.

Adjustable System Fees

The effective commission estimation of the Coinomi system during transfer or swap. The wallet considers the line in the mempool; the greater it is, the minimum the percentage for the app. Users can freely set the system fee, approximating or moving where they are in the queue.

Benefits of Coinomi Wallet

- According to the developers, Coinomi provides top-level security.

- There is presently zero credible proof of wallet hacking or digital currency theft.

- Cross-platform. After testing its desktop edition of the digital currency wallet, Coinomi will become more affordable and multitasking.

How to Create Coinomi Wallet

To generate the Coinomi Wallet from your smartphone device, you must develop a strong password. Coinomi doesn’t ask for an email address or mobile number. You should choose which digital currency you wish to use with the wallet. You can add all the 63 supported coins or pick the desired one.

If you need more coins in the future, you can visit this section and hit the Start Scanning button, which will add other coins you haven’t added to the wallet. Note: this is only applicable to the foremost account you create. If you generate more accounts, you must manually add more assets. After finishing these steps, your wallet will become ready to use.

Earlier, users required the Android emulator such as Bluestacks to utilize Coinomi Wallet on a computer, but no more. You should first download & install the wallet on your PC before using it on the desktop. Only Mac OS, Windows, and Linux users can access it.

Guide to Use Coinomi Wallet

- Users can check their balance in fiat currency and the complete amount of their digital currency on the home screen of the Coinomi mobile app.

- You will find an ellipsis at the top right side. If you tap on it, the option to import a paper wallet through a QR code, private key, or re-synchronization will appear.

- You will find the main menu icon at the top left side. Tapping on the menu icon will display the option to swap and sell.

- The list of your accounts is also accessible, together with the investment option. You will also get Support, Settings, About, +Token, and +Coin on the main menu.

- Users can access the support page by pressing the Support button. Users can read existing knowledge base questions on this page or provide the Support Ticket for Agent Support.

- You can check all the important information about the app and read the Terms of Services on the About Us page.

Fees Structure of Coinomi

You don’t need to pay to install or utilize the Coinomi Wallet. The only charges related to receiving, transferring, and swapping digital currency are the network costs that are important for all other kinds of transactions. Also, the users can select how much they wish to pay for their transactions.

For instance, you can select the Low option if you wish to wait for more to transfer a coin. Users who can’t wait for long and wish to transfer instantly can choose the High option, increasing the transaction process, or they can pick the Dynamic option for more flexibility.

Is Coinomi Wallet Secure?